What is a Stripe Payment Link?

Stripe Payment Links are a relatively new product from Stripe, and it could be argued that they are underutilized. Part of the reason might be that it can initially sound too good to be true. A small business with a WordPress site can set up a static catalog page for products, subscription services, or direct tips/donations. Using Payment Links set up in the Stripe dashboard, they can start accepting online payments with no further development effort.

With Payment Links, your business can take payments and/or sell subscriptions without additional standalone websites or applications. You can share these Payment Links an unlimited number of times in a variety of places – like your website, in emails, and on social media.

Payment Links support over 20 payment methods, including credit and debit cards, Apple Pay, and Google Pay. The Payment Link automatically matches your customer’s preferred browser language for over 30 languages.

It’s so simple it can be hard to visualize.

Stripe Payment Links Demo

Sometimes, it can be easier to show than to tell, so here is a demonstration. The Stripe dashboard experience of creating a Payment Link includes an interactive preview of the end user experience as you define your Payment Link.

Most business owners are not technologists. They are, however, savvy about the advantages of having a flexible, powerful, and secure customer payment process. Many are likely to have had prior experience setting up some kind of payment system. And this may be where the confusion about Payment Links creeps in. Until you wrap your head around it, it’s reasonable to assume there is going to be significant effort involved or that there must be some significant catch.

For example, there may be a concern that a no-code option will mean complicated integration with the accounting software, fulfillment systems, etc. The good news is that there are also powerful tools to handle fulfillment and customize what happens after a Payment Links payment.

Customizing Payment Link Payments

Track Payments

Your Dashboard includes a payment overview, where you can see which customers have made a payment using a Payment Link and when they did so.

You control if you want to receive emails for all successful payments in your profile settings.

For one-time payments, Stripe creates a new guest customer. For customers purchasing a subscription or saving a payment method for future use, Stripe creates a new Customer.

Automatically Handle Post-Purchase Activities

You can automate post-purchase activities like order fulfillment, order-related emails, customer database updates, and accounting system updates. We recommend taking this one step further and connecting Stripe data to your other business applications using event flow-based tools like Soliant.cloud, Claris Connect, Zapier, etc.

Payment Links can also handle sophisticated fulfillment use cases programmatically with the Stripe API and webhooks after a customer pays via a Payment Link. These options require custom code but are fully compatible with no-code Payment Links.

Change Confirmation Behavior

After a successful payment, your customer sees a localized confirmation message thanking them for their purchase. You can then increase engagement with your new customer by customizing the confirmation message or redirect to a URL of your choice. To change the confirmation behavior on a Payment Link, click the Confirmation page tab when creating or updating a Payment Link.

Per the excellent online Stripe documentation, “if you redirect your customers to your own confirmation page, you can include {CHECKOUT_SESSION_ID} in the redirect URL to dynamically pass the customer’s current Checkout Session ID. This is helpful if you want to tailor the success message on your website based on the information in the Checkout Session. You can also add UTM codes as parameters in the query string of the Payment Link URL. The UTM codes are automatically added to your redirect URL when your customer completes a payment.”

Encourage Customers to Manage Their Subscriptions

Create a link that you can send to customers, letting them log in and manage their subscriptions using the customer portal. A detailed discussion of Stripe Customer Portals is beyond the scope of this post and is a topic we may dive into in a future post. In the meantime, Stripe hosts a live demo you can explore.

Send Email Receipts

Stripe can automatically send email receipts to your customers after successful payments. You can enable this feature with the “email customers for successful payments” option in your email receipt settings. We touched on this briefly in the Payment Link setup video above. We encourage you to take full advantage of the ability to customize the color and logo shown on your receipts in the branding settings of your Dashboard.

View Payment Link Metrics

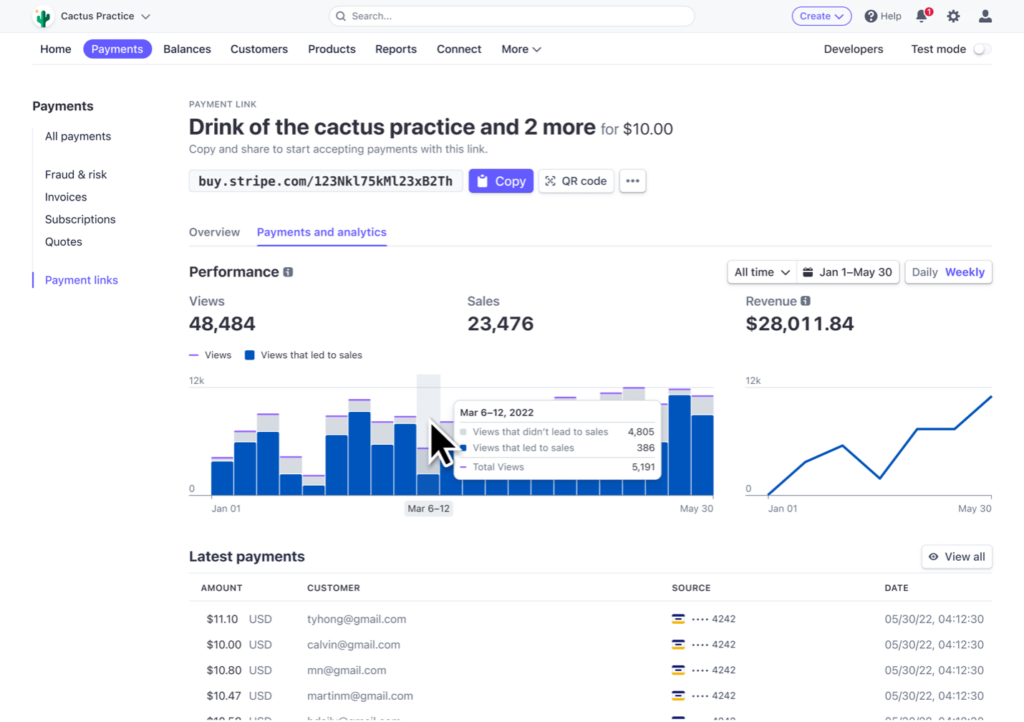

You can see metrics such as views, sales, and revenue from a given Payment Link. Just click the Payments and analytics tab after selecting a Payment Link from the list view. Take a look at this example of Payment Link metrics from the official Stripe documentation.

You can use this data to better understand how your link is performing and what its conversion rate is. Per the Stripe documentation, you get access to the following metrics:

- Views: The number of times your Payment Link was opened.

- Sales: The number of times the Payment Link was used to complete a purchase.

- Revenue: The gross sales volume that the link generated and is always in your default currency regardless of the presentment currency. Stripe converts the amounts using the exchange rate on the day the payment occurs.

Who Uses Payment Links and Why?

Payment Links allow businesses to drive simple and easy-to-use online purchasing power for their customers. They are used across a wide range of industries, both for B2C and B2B applications, and work for almost any type of online purchase.

Here are a few example use cases where Payment Links can facilitate customer transactions:

You have a product that is not sold directly online.

Maybe you’re a B2B company and don’t plan to set up e-commerce online at all. You provide professional services or complex products that cannot be sold without a client services team. You invoice your customers from an existing system. For your customer’s convenience, you’d like to offer a link for their payment to process invoices generated offline.

You only need to sell a limited number of products.

You might have a relatively small number of products that you want to sell online. For businesses who can manage their products and inventory manually through the Stripe dashboard, it can be cost inefficient to do an automated product integration. In this case, Payment Links can be an ideal solution.

You’re fundraising or collecting donations.

For businesses who want to host an open-ended donation link with a user-selected amount to donate, Stripe Payment links are an ideal solution.

You need to accept payments in person without POS hardware.

For vendors who sell physical goods in person, a Payment Link can be used to allow customers to easily use a mobile device to make payments as an alternative to cash or a traditional POS system.

No matter what you’re selling, where you sell it, or the audiences you cater to, Payment Links offer an agile tool for your business. If you don’t have a website or don’t have one that supports e-commerce but are interested in selling your goods, services, or subscriptions to customers online, creating online Payment Links might be a good fit for you. Far from being a one-size-fits-all e-commerce tool, direct Payment Links are more like a “one-tool, any-size” solution that takes on some of the most nagging challenges of selling to customers online.F

From “Payment links: What they are and how to use them.“

Launching Payment Links with a Stripe Consulting Partner

Stripe makes implementing its payment processing platform easy, but getting the most out of its functionality often requires custom development. Our team specializes in helping companies build tailored business systems and integrate mission-critical applications. We eliminate growth barriers and seize new opportunities for our clients. As a Stripe Consulting Partner, we can help you customize Stripe for your unique business needs. Contact us today to talk to a consultant.